Environment

Information Disclosure Based on TCFD

The Group engages to resolve social issues to realize a prosperous and sustainable future society with customers and partners globally. Climate change is considered a significant social issue and exerts a grave impact on the global environmen t, peoples lives, and business activities. The Group has identified promote a decarbonized society and realize the circular economy as priority key challenges (materiality) related to the environment.

The Group expressed its support for the recommend ations of the Task Force on Climate related Financial Disclosures (TCFD) in November 2021, and is intensifying efforts to reduce its greenhouse gas ( GHG emissions. In addition, the Group will work to realize a decarbonized society by contributing to the decarbonization of customers through its business activities.

① Governance

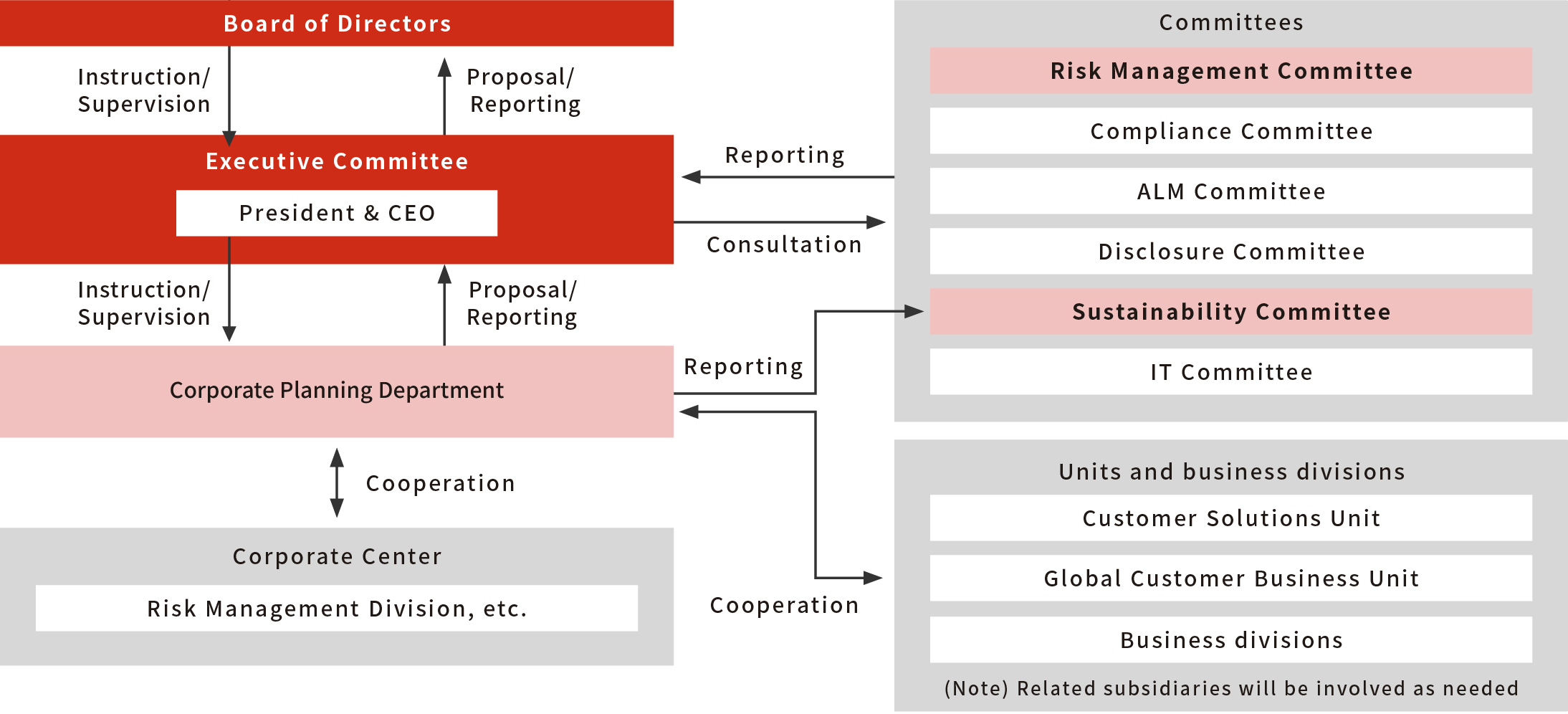

The Group established the Sustainability Committee in April 2021 to better contribute to the realization of a sustainable and prosperous future. This Committee is considered one of the advisory bodies to the Executive Committee and meets to discuss the climate change issue and other key challenges related to sustainability. The results of the deliberations are reported to the Executive Committee and the Board of Directors. The Materiality announced in December 2021 that includes promotion of a decarbonized society was identified through deliberations by the Sustainability Committee, Executive Committee, and Board of Directors. The Group will promote efforts to identify and manage the impact of climate change on business and reinforce its governance.

Supervision of the Board of Directors and the roles of top management

The Mitsubishi HC Capital Group’s Sustainability Promotion Framework

Organizational entities and roles in the sustainability promotion framework

| Organizational Entities | Roles |

|---|---|

| Board of Directors | The Board of Directors identifies the Group’s basic policies including materiality and periodically confirms the status of business managed and executed based on these basic policies. |

| Executive Committee | The Executive Committee resolves Group-wide measures that relate to management, including response policies, action plans, and the progress of metrics for the Group’s materiality and environmental issues. Important matters are reported to the Board of Directors. |

| Risk Management Committee | The Risk Management Committee manages risks related to overall management in comprehensive and systematic ways. The overall impact on climate change risks, human rights risks, and other major risks is reported to the Executive Committee. The committee is chaired by the Head of the Risk Management Division, and its members consist of the President & CEO, Deputy Presidents, Head of the Corporate & Strategic Planning Division, Head of the Treasury & Accounting Division, Head of the Credit Division, Head of the IT & Operations Division, and officers in charge of auditing. In principle, the committee meets twice a year. |

| Sustainability Committee | The Sustainability Committee formulates long-term plans related to the Group’s sustainability promotion, including materiality and environmental issues, as well as goals and plans for non-financial metrics. The committee also monitors the progress of metrics set by each business division and reports important matters to the Executive Committee. The committee is chaired by the Head of the Corporate & Strategic Planning Division, and its members comprise the President & CEO, Deputy Presidents, Head of the Treasury & Accounting Division, Head of the Human Resources & General Affairs Division, Head of the Risk Management Division, Head of the Credit Division, and Head of the IT & Operations Division. In principle, the committee meets twice a year. |

| Corporate & Strategic Planning Division | The Corporate & Strategic Planning Division is in charge of drafting and driving the execution of plans for Group-wide strategies based on the Group’s basic sustainability policy. It gathers knowledge related to the Group’s sustainability from Japan and overseas, drafts policies and strategies, and reports those matters to the Sustainability Committee and other committees. |

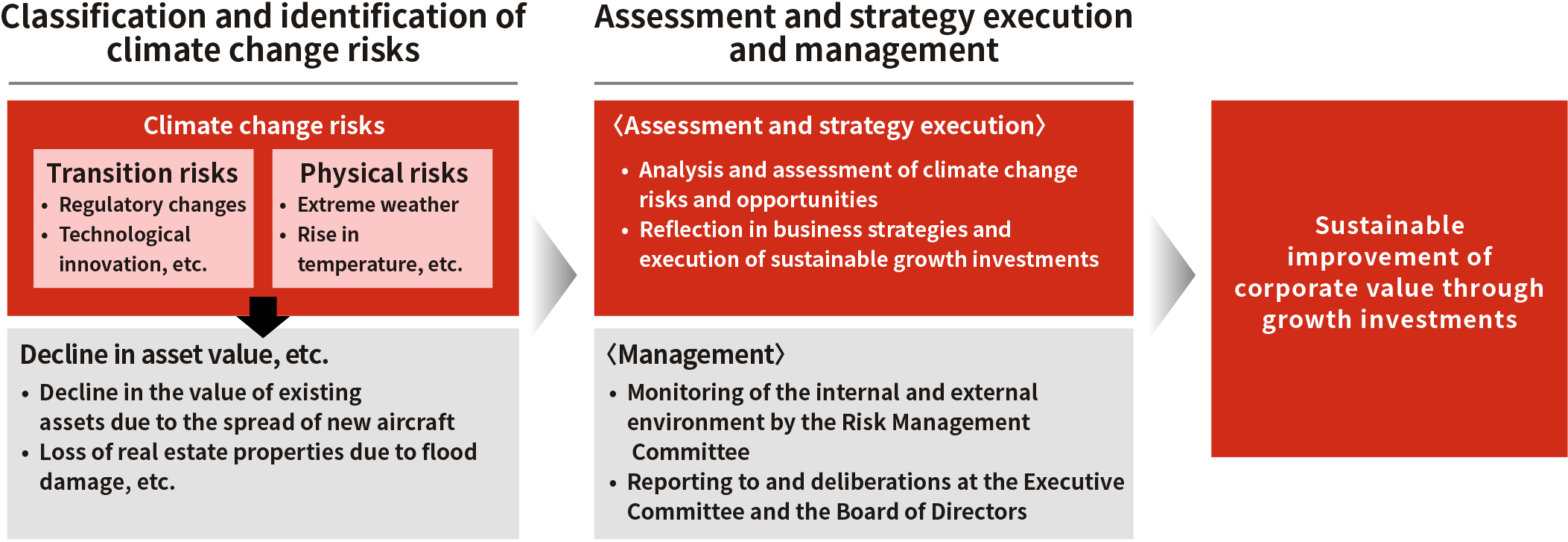

② Risk Management

Regulatory changes, technological innovation, and shifts in business models in line with the transition to a decarbonized society or extreme weather, etc. stemming from global warming may affect our operating results and financial condition in the form of the business failure of business partners due to earnings deterioration and other factors, the decline in value of assets owned by the Group, and in other ways. The Group recognizes climate change risk as one of the critical risks in Company-wide risk management and will promote efforts to properly identify and manage it.

a.Risk management system overview

The Group uses its integrated risk management framework to comprehensively manage risks that could have a substantial impact on investors' decisions.

The important risks managed within the integrated risk management framework include, but are not limited to, credit risks, asset risks, investment risks, market risks, liquidity risks, and operational risks.

To manage envisaged risk factors, the departments overseeing specific risks monitor issues arising from developments in the external environment or other changes, regularly consider measures to address such risks, and then report and deliberate them at meetings of each committee including the Risk Management Committee. In addition, we operate a risk management system in which important matters are reported to and discussed by the Executive Committee and Board of Directors.

b.Classification and examples of impacts of climate change risks

Climate change risks consist of transition risks associated such as with tightening of climate-related regulations and technological innovation, and physical risks associated with extreme weather and changes in climates. The TCFD recommendations classify these risks into the subcategories of policy and legal/technology/market/reputation, and acute/chronic, and present examples of impacts.

We believe that impacts will occur over a variety of time frames (short, medium, and long term) through broad transmission routes including existing risks such as credit risks, asset risks, and investment risks. Furthermore, in addition to direct impacts on the Group’s business activities, the onset of indirect impacts through the Group’s customers is also possible.

Based on such risk characteristics and the details of the TCFD recommendations, we categorize examples of impacts of climate change risks for each of the Group’s major risks, also taking into account its risk management framework. Under the integrated risk management framework, we are building a system to identify, assess, and manage climate change risks in light of their relation to other major risks.

Going forward, we will review the risk classification and examples of impacts in accordance with the extent of our analysis and assessment of changes in the external environment and climate change risks.

Classification and examples of impacts of climate change risks

| Major Risks | Timeframe* | Transition risk | Physical risk |

|---|---|---|---|

| Credit Risk | Short to long term |

|

|

| Asset Risk | Short to long term |

|

|

| Investment Risk | Short to long term |

|

|

| Market Risk | Short to long term |

|

|

| Liquidity Risk | Short to long term |

|

|

| Operational Risk | Short to long term |

|

|

| Reputational Risk | Short to long term |

|

|

| Strategic Risk | Medium to long term |

|

|

- * Short term: until 2025, Medium term: until 2030, Long term: until 2050

(Reference) Classification and Examples of Impacts in the TCFD Recommendations

Transition risks: Risks related to the transition to a lower-carbon economy

| Type | Environmental Changes Brought by Climate Change | Impacts on Customers/MHC, etc. |

|---|---|---|

| Policy and Legal Risk |

|

|

| Technology Risk |

|

|

| Market Risk |

|

|

| Reputational Risk |

|

|

Physical risks: Risks related to physical changes caused by climate change

| Type | Environmental Changes Brought by Climate Change | Impacts on Customers/MHC, etc. |

|---|---|---|

| Acute Risk |

|

|

| Chronic Risk |

|

|

c.Status of integration into overall risk management

We have a system in place where various impacts of climate change risks on other major risks are reported and deliberated at the Risk Management Committee. We will integrate the management of such risks, including risks identified through scenario analysis, in overall risk management by establishing a monitoring system and other means.

Additionally, the development of targets and plans related to climate change and details of monitoring are reported and deliberated at the Sustainability Committee. The details of deliberations of both committees are reflected in our Group’s overall management strategies under the Board of Directors’ supervisory system, allowing us to appropriately respond from the perspectives of both overall risk management and individual risks.

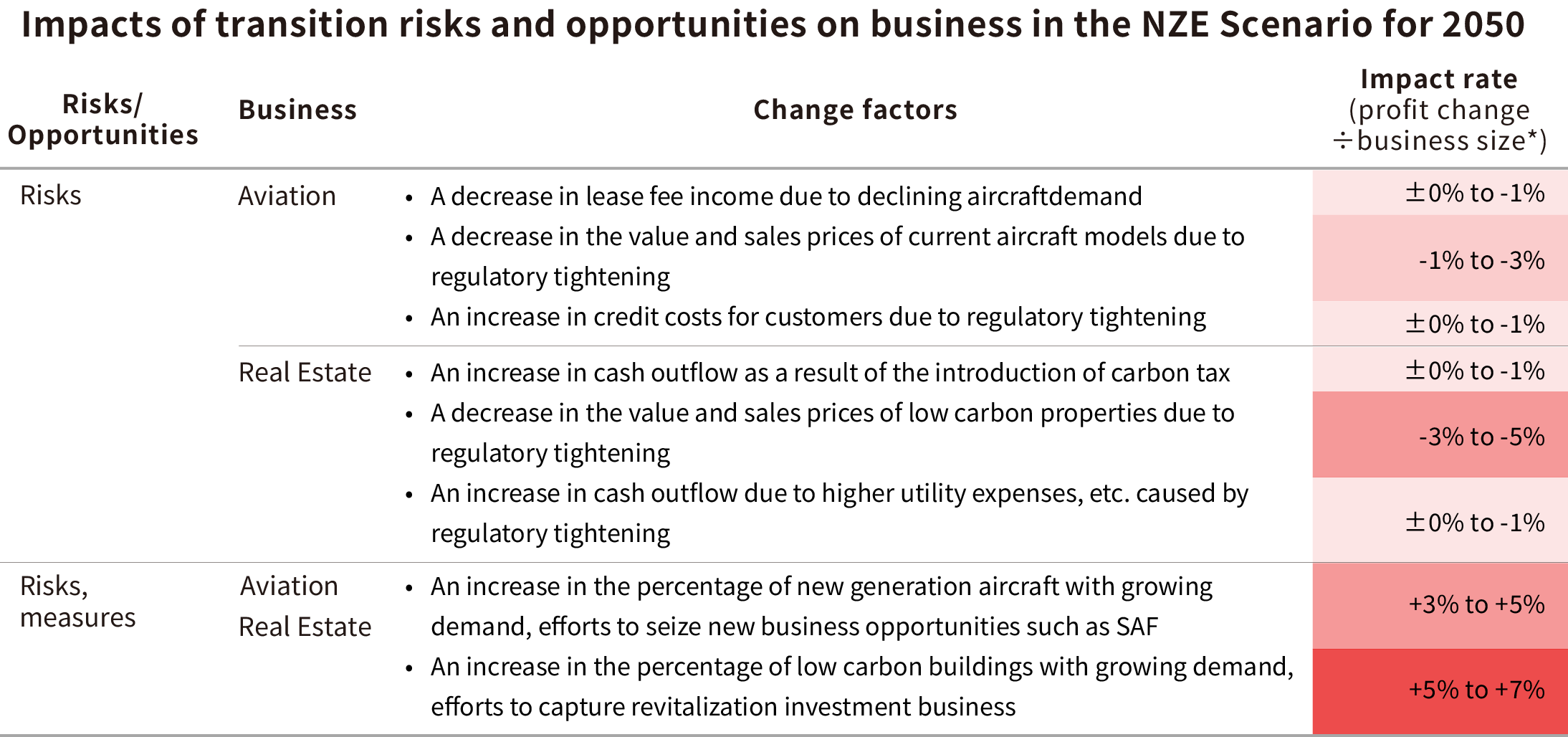

③ Strategy

We identify risks and opportunities for the Group brought by future climate change, and conduct scenario analysis on transition risks and physical risks for the purpose of appropriately disclosing information and considering future measures.

While we assessed transitions risks generally in qualitative terms, we also assessed them quantitively for particularly important segments.

The scenario analysis was carried out based on information and data available at present. We will obtain more information and related data through careful interpretation of the analysis results and dialogues with stakeholders and strive to disclose information appropriately by improving our analysis methods and expanding the scope of businesses to be analyzed.

a.Overview of the scenario analysis

Overview of transition risk analysis

| Target sectors and main segments |

Target Sector | Main Segment |

|---|---|---|

| Energy (oil, gas, coal, and electric utilities) | Environment & Energy | |

| Transportation (air freight and passenger air transportation) |

Aviation | |

| Materials and Buildings (real estate management and development) |

Real Estate | |

|

||

| Sector and segment selection method |

|

|

| Scenario |

|

|

| Reason for selecting the above scenario |

|

|

| Analysis method |

|

|

Overview of physical risk analysis

| Subjects of analysis |

|

|---|---|

| Scenario |

|

| Reason for selecting the above scenario |

|

| Analysis method |

|

b.Results of the scenario analysis

Discussions about the impacts of climate change on our business were held with each division in charge of Environment & Energy, Aviation, Real Estate, and Customer Solutions, which are the target segments of the scenario analysis, and with the Risk Management Department, which is the department in charge of risk management for the entire Group, to ensure consistency between scenario analysis results and existing strategic policies.

The Group endeavors to minimize risks and maximize opportunities by taking short- and long-term measures regarding risks and opportunities related to climate change. As a result of the qualitative scenario analysis of transition risks, we recognize the need to appropriately handle risks and opportunities associated with the expansion of renewable energy (Environment & Energy), the shift to fuel-efficient aircraft and aircraft engines and low-carbon fuels such as SAF and hydrogen (Aviation), growing demand for low-carbon buildings (Real Estate), and other trends. The results of the quantitative scenario analysis suggest that the Aviation segment is expected to see lower lease fee income due to declining aircraft demand, a decline in the value of current aircraft models due to regulatory tightening, and increased credit costs for airline companies. Meanwhile, resilience is expected to be strengthened thanks to an increase in the percentage of new generation aircraft *1 with growing demand and the implementation of strategies and measures to seize new business opportunities such as SAF.*2 The Real Estate segment is expected to see increased outflow of cash as a result of the introduction of carbon tax, a decline in the value of low-carbon buildings due to regulatory tightening, and increased outflow of cash due to higher utility and other expenses. Meanwhile, resilience is expected to be strengthened thanks to an increase in the percentage of low carbon buildings with growing demand and the implementation of strategies and measures to seize opportunities such as revitalization investment business.

Furthermore, based on the results of the physical risk analysis, we anticipate risks including damage caused by disasters to power stations and deterioration of power generation facilities such as solar panels (Environment & Energy), loss in the value of real estate due to intensification of natural disasters and increases in construction and operation expenses and renovation costs (Real Estate), and damage caused by disasters to the Group’s offices and increases in their operation expenses and insurance costs.

While appropriate measures for climate change risks have been developed, in terms of the opportunities brought by climate change, the acquisition of business opportunities has been incorporated into our strategies. We have also set metrics related to climate change and established a system to regularly monitor relevant trends in Japan and overseas and the status of initiatives of the Group.

*1. Fuel-efficient aircraft that emit less CO2 compared with the current generation

*2. SAF: Sustainable aviation fuel.

Results of the scenario analysis

| Types of risks/ opportunities | Timeframe*1 | Details of climate change-related risks and opportunities | Measures to address risks / Measures to realize opportunities | ||

|---|---|---|---|---|---|

| Risks | Transition risk |

Policy and legal |

Short to long term |

|

|

| Technology | Short to long term |

|

|

||

| Market | Short to long term |

|

|

||

| Reputation | Short to long term |

|

|

||

| Physical Risk | Short to long term |

|

|

||

| Opportunities | Products and Services |

Short to long term |

|

|

|

| Markets | Short to long term |

|

|

||

| Long term |

|

|

|||

- Short term: until 2025, Medium term: until 2030, Long term: until 2050

Results of the quantitative scenario analysis

- Business size refers to the sales volume assumed in the STEPS scenario for 2050 (total cash inflow for the Real Estate segment)

The figures above are the results of calculating the rates of future impacts based on the scenarios and other data published by major institutions, and their accuracy is not guaranteed. The initiatives above have been set as preconditions for calculating the rates of future impacts and do not indicate action plans for such initiatives.

④ Metrics and Targets

Our Group recognizes the realization of a decarbonized society as an urgent issue and has defined our Group’s ideal state based on national policy targets and Our 10-year Vision. We then set environmental targets by working backward from that vision. Now we view the promotion of a decarbonized society as an even more important opportunity and are actively working on relevant efforts.

In such cases as where GHG emissions increase significantly in the future due to efforts for new businesses or other activities, or where numerical values change as the calculation of GHG emissions of the entire Group including its supply chain is further refined, the established targets may be revised if necessary, but we plan to set the targets so that they will be in line with national policy target levels, just as the current targets are.

a. The Groupʼs environmental targets

| Metrics | FY2030 target | FY2024 result |

|---|---|---|

| The Group’s GHG Emissions (Scope 1 and Scope 2) |

5,081t-CO2e (−55% compared to FY2019) |

4,458t-CO2e (−61% compared to FY2019)*1 |

| Percentage of new generation aircraft in our portfolio*2 |

83% | 76% |

| Percentage of green buildings in our portfolio*3 |

64% | 65% |

| Total new transactions volume of leasing of decarbonization‑related assets*4 |

¥102.0 billion | ¥11.6 billion |

| Power generation capacity in operation corresponding to the Group’s stake*5 |

Approx. 2.3GW | 1.18GW |

- The target for FY2030 was achieved ahead of schedule. A new target is planned to be established.

- Fuel-efficient aircraft that emit less CO2 compared with the current generation. Models: A220, A320NEO, A321NEO, A330NEO, A350, B737MAX, B787.

Targets and results are both calculated based on net book value (Jackson Square Aviation’s business) - In the real estate business, the share (number of buildings) of environmentally certified properties (CASBEE, DBJ Green Building, BELS, etc.) or buildings using 100% renewable energy among assets over which the Group has some degree of control (Mitsubishi HC Capital Realty’s investment properties) and assets under management by the Group’s asset management companies with the Company acting as a sponsor (Mitsubishi HC Capital Realty Advisers’ private REITs + CenterPoint Development’s private placement funds)

- Total transactions volume of leasing mainly of the following equipment (GX Assessment Lease) for FY2024 and beyond:

- Equipment for which CO2 reduction effects generally required in green finance can be expected

- Energy-environment friendly products

- Machinery for the ESG lease promotion business

- Power generation capacity corresponding to the Group’s stake in the domestic renewable power generation business

b.Future efforts

To further enhance the effectiveness of promoting a decarbonized society, our Group has compiled our initiatives and progress since setting Scope 1 and 2 targets, along with processes toward achieving our interim Scope 3 targets, and formulated the Transition Plan toward the Realization of a Carbon-neutral Society. By promoting and sophisticating these initiatives, we aim to realize carbon neutrality across our entire supply chain by 2050.