Governance

Corporate Governance

- Basic Views on Corporate Governance

- Corporate Governance Framework

- Appointment and Dismissal of Directors

- Structure of the Board of Directors and Areas of Expertise by Directors

- Status of Activities of the Board of Directors, Audit & Supervisory Committee, and Other Committees

- Evaluation of the Effectiveness of the Board of Directors

- Remuneration for officers

- Policy for Constructive Dialogue with Shareholders

- Cross-shareholdings

- Corporate Governance Report

Basic Views on Corporate Governance

While emphasizing initiatives to achieve sustainable corporate growth and improvement in corporate value over the medium to long term, MHC aspires to contribute to a more prosperous society by respecting the rights and interests of all of its stakeholders–shareholders, customers, local communities, and employees–and fulfilling their trust in the Company, based on the views presented below.

With the recognition that it is one of its social responsibilities to ensure transparent and sound management, MHC continues to work on initiatives to enhance corporate governance by boosting the activity of the Board of Directors, reinforcing the Audit & Supervisory Committee and the internal audit system, ensuring timely and appropriate disclosures of information, and actively engaging in investor relations (IR) and other activities.

(1) Fostering Sound Corporate Culture

In accordance with Our Vision, which guides all of MHC’s activities, and the Mitsubishi HC Capital Group Code of Ethics and Code of Conduct, which serve as standards for the decisions and behaviors of all employees, MHC strives to understand the diversity of its various stakeholders including shareholders, customers, local communities, and employees and foster a corporate culture that respects their rights and perspectives and sound business activities.

(2) Ensuring Appropriate Information Disclosure and Transparency

MHC conducts proactive and continuous information disclosure in order to be trusted and properly evaluated by each of its stakeholders. It also establishes and appropriately operates internal systems to facilitate the swift and impartial disclosure of accurate information regarding its management policies, business strategies, business activities, financial condition, etc. In addition to the items MHC is required to disclose pursuant to laws and regulations, it actively and voluntarily discloses non-financial information deemed useful to its stakeholders.

(3) Ensuring the Rights and Equal Treatment of Shareholders

MHC takes appropriate steps to ensure that the rights of shareholders are secured and can be exercised effectively and all shareholders including minority shareholders and foreign shareholders are treated equally.

(4) Constructive Dialogue with Shareholders

Through events such as General Meetings of Shareholders, financial results briefings, and other domestic and overseas investor relations events, MHC pursues proactive and constructive dialogue with diverse shareholders. It thereby seeks to gain understanding from shareholders regarding matters such as its business strategies and further enhance corporate governance through dialogue.

(5) Ensuring Effectiveness of the Board of Directors

All members of the Board of Directors call upon their experience and insight as they engage in free and open discussions, supporting appropriate risk-taking. In this manner, they adequately fulfill their duties and responsibilities to achieve the sustainable growth of MHC, improvement in its corporate value over the medium to long term, enhancement of its capital efficiency and other figures, etc.

Corporate Governance Framework

MHC is a company with an Audit & Supervisory Committee and has established a Board of Directors to be responsible for important decision-making and supervisory functions, and an Audit & Supervisory Committee to be responsible for audit and supervisory functions.

In order to further enhance its corporate governance, MHC has also established a Nomination Committee and a Compensation Committee to serve as advisory bodies to designate the President & CEO and determine the remuneration, etc. of Directors. Further, MHC has established a Governance Committee, which consists of Outside Directors, Representative Directors, etc., to serve as an advisory body to the Board of Directors regarding the improvement of the effectiveness of the Board of Directors, etc.

Alongside adopting an executive officer system, MHC has established an Executive Committee to serve as a body for deliberation and decision-making on important management matters.

<Matters Concerning the Board of Directors>

MHC implements a system to manage and operate business in line with the basic policy of the MHC Group decided by the Board of Directors. MHC’s Directors possess qualities appropriate for their positions, giving the Board of Directors a set of diversified and sufficient skills.

In addition, for timely, appropriate, and smooth provision of information particularly to Outside Directors, the General Affairs Department serves as the secretariat for the Board of Directors, and the Audit & Supervisory Committee Office has been established to assist the duties of Directors who are Audit & Supervisory Committee Members.

MHC is engaged in initiatives for stimulating discussions on important agenda items, such as (1) providing prior explanations, (2) having several times of deliberations at Board of Directors meetings, and (3) regularly confirming the progress of the items after decisions are made.

Each year, all Directors conduct a review of activities of the Board of Directors and evaluate its effectiveness. In addition, discussions attended only by independent Outside Directors and meetings for independent Outside Directors to exchange opinions with the Chairman and the President & CEO are held regularly, and in the event that an issue, etc. is raised there, it will be appropriately responded to and improved.

<Matters Concerning the Governance Committee, Nomination Committee, and Compensation Committee>

MHC has established the Governance Committee, consisting of the Outside Directors, Representative Directors, etc., which exchanges a wide range of opinions on the improvement of the Board of Directors’ effectiveness and other matters regarding the Board of Directors, in order to work on the improvement of the soundness, transparency, and fairness of management.

MHC, based on the understanding that appropriate involvement of independent Outside Directors is important for resolutions related to nomination and remuneration, has established the Nomination Committee and Compensation Committee, of which independent Outside Directors comprise the majority. In addition, from the perspective of enhancing the independence and objectivity of the functions of the Board of Directors and its accountability, since April 1, 2025, MHC has assigned independent Outside Directors as the chairpersons of the committees.

The Nomination Committee discusses the appointment of Directors, the succession plan for the President & CEO, knowledge, experience, skills, etc. that the Board of Directors should have, and other matters.

The Compensation Committee regularly monitor MHC Directors’ remuneration in comparison with the market standard by using an external specialized agency, and discusses policies, etc. concerning the systems, standards, etc. for officers’ remuneration.

<Matters Concerning Business Execution>

As a company with an Audit & Supervisory Committee, MHC delegates business execution decisions to the Executive Committee, a body which will deliberate and decide on important management matters, within an appropriate scope, and expedites the decision-making process, in order to further strengthen the supervisory functions of the Board of Directors. In addition, MHC has adopted an executive officer system, in order to further enhance and invigorate the functions of the Board of Directors by clarifying the responsibilities related to the execution of business.

The Executive Committee is composed of the President & CEO, Deputy Presidents, and Executive Officers separately specified by the President & CEO. In principle, the committee deliberates on matters to be submitted to the Board of Directors in advance in order to facilitate decision-making by the Board of Directors, in addition to holding deliberations and making decisions on important matters, including the business management of the Group.

<Status of Audits>

MHC has established the Internal Audit Department as a department in charge of internal audits.

The Internal Audit Department systematically implements internal audits based on an annual audit plan, and reports the audit results to the Representative Directors, the Board of Directors, and the Audit & Supervisory Committee.

With regard to findings that require improvement, for which guidance was provided to the divisions subject to audits (important findings), those divisions are to report the results of improvement to the General Manager of the Internal Audit Department, and the Internal Audit Department reports the important findings to Representative Directors, in order to ensure the effectiveness of the audit.

The Audit & Supervisory Committee comprises a total of four persons, including one Director and three independent Outside Directors.

Through the activities from 1) Deliberations, etc. among the Audit & Supervisory Committee, 2) On-site observations of offices in Japan and overseas, and 3) Meetings with the management team, the Audit & Supervisory Committee works to conduct objective and effective audits from an independent position.

Accounting audits are implemented by Deloitte Touche Tohmatsu LLC in collaboration with the Audit & Supervisory Committee and the Internal Audit Department, based on an audit agreement, and in conjunction with matters such as the provision of relevant information by the internal control departments.

Appointment and Dismissal of Directors

The Board of Directors resolves to appoint candidates to serve as Directors based on the selection standards described below, after the Nomination Committee, of which independent Outside Directors comprise the majority, holds discussions in advance. (It is stipulated in internal regulations that the Board of Directors shall resolve with the utmost respect to the decisions made by the committee.) The Board of Directors also resolves to appoint candidates to serve as Directors who are also Audit & Supervisory Committee Members after the Nomination Committee discusses it and the Audit & Supervisory Committee agrees to it.

MHC also recognizes that diversity at the Board of Directors in terms of gender, nationality, race, etc. is important, and proactively works on strengthening the function of the Board of Directors by enhancing diversity.

In determining an appropriate composition of the Board of Directors, MHC believes, as a desirable way of achieving diversity within MHC, that it is necessary to elect desirable persons in consideration of gender, nationality, race, etc., making it a top priority that Directors can demonstrate the necessary skills and abilities in light of the respective management environment.

In addition, if Directors are found to meet the dismissal standards described below, their dismissal is deliberated by the Nomination Committee in a timely manner and decided by the Board of Directors.

<Selection Standards>

- Directors and Audit & Supervisory Committee Members should have the mental and physical soundness sufficient to execute business.

- Directors and Audit & Supervisory Committee Members should be persons who are well respected, possess excellent integrity, and hold themselves to high ethical standards.

- Directors and Audit & Supervisory Committee Members should have a law-abiding mentality.

- Directors and Audit & Supervisory Committee Members should be expected to make objective judgments regarding management and have excellent insight and perspicacity.

- It is reasonable to consider that the candidates will help strengthen the functions of the Board of Directors in view of their knowledge, experience, capabilities, and similar factors.

- In addition to 1. to 5. above, candidates for Outside Directors should (i) have experience, achievements, and knowledge in their fields of specialization, (ii) be able to contribute to the implementation of appropriate decision-making and management supervision of the Board of Directors, and (iii) be expected to secure the time necessary to fulfill their duties.

- Candidates for reappointment should have performed roles expected of them during each of their previous assignments.

<Dismissal Standards>

- Directors significantly damaged the value of MHC by neglecting their duties.

- Directors violated laws, articles of incorporation, or other regulations/rules of MHC, or conducted an act against public order and/or morals, which caused serious damage to MHC or hindrance to the business of MHC as a result.

- Directors are deemed to not meet the selection standards for Directors.

Structure of the Board of Directors and Areas of Expertise by Directors

MHC has selected nine skills that the Board of Directors should possess: "corporate management," "finance," "global," "sustainability," "sales/marketing," "IT/DX," "finance/accounting," "risk management/legal affairs," and "human resource management." It recognizes that the skills the Board of Directors shall possess must be reviewed regularly based on its management strategies and environment, and thus it will continue to consider this issue at Governance Committee and Nomination Committee meetings.

MHC also recognizes that diversity at the Board of Directors in terms of gender, nationality, race, etc. is important, and proactively works on strengthening the function of the Board of Directors by enhancing diversity.

In determining an appropriate composition of the Board of Directors, MHC believes, as a desirable way of achieving diversity within MHC, that it is necessary to elect desirable persons in consideration of gender, nationality, race, etc., making it a top priority that Directors can demonstrate the necessary skills and abilities in light of the respective management environment.

Currently, it is assumed that MHC’s Board of Directors consists of Directors from a variety of business categories and industries and has an appropriate number of members to ensure a balanced composition of appropriate skills and diversity.

Although no foreign Director has currently been elected, MHC acknowledges that the Board of Directors has been performing a supervisory function, as it has elected several Directors who possess a wealth of international business experience, and has received valuable opinions on global business development.

<Changes in the Ratios of the Board of Directors>

| Number of Directors | Non-executive Directors | Independent Outside Directors | |

|---|---|---|---|

| April 2021 | 15 | 53% | 33% |

| June 30, 2021 | 15 | 60% | 33% |

| June 30, 2022 | 14 | 57% | 36% |

| June 30, 2023 and beyond | 12 | 67% | 42% |

<Reasons for Selection of the Skills>

| Category | Skill | Reason for Selection | |

|---|---|---|---|

| Matters Related to Overall Management | Corporate Management |

|

|

| Finance |

|

||

| Global |

|

||

| Sustainability |

|

||

| Matters Related to Revenue Growth | Sales/Marketing |

|

|

| Matters Related to Strengthening Corporate Functions | IT/DX |

|

|

| Finance/ Accounting |

|

||

| Risk Management/ Legal Affairs |

|

||

| Human Resource Management |

|

||

<Skills That Should be Possessed by the Board of Directors (Skill Matrix) and Each Committee’s Members>

as of December 26, 2025

| Name | Position | Matters Related to Overall Management | The members of each Organization | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Matters Related to Revenue Growth |

Matters Related to Strengthening Corporate Functions |

||||||||||||||

| Corporate Management |

Finance | Global | Sustain- ability |

Sales/ Marketing |

IT/DX | Finance/ Accounting |

Risk Management/ Legal Affairs |

Human Resource Management |

Board of Directors |

Audit & Supervisory Committee |

Governance Committee |

Nomination Committee |

Compensation Committee |

||

| Takahiro Yanai | Director, Chairman |

● | ● | ● | ● | ● | ● | ● | ● | ◎ | ◎ | ○ | |||

| Taiju Hisai | Representative Director, President & CEO |

● | ● | ● | ● | ● | ● | ● | ● | ○ | ○ | ○ | |||

| Aiichiro Matsunaga | Representative Director, Deputy President |

● | ● | ● | ● | ● | ● | ● | ○ | ○ | |||||

| Kazumi Anei | Director, Deputy President |

● | ● | ● | ● | ● | ○ | ||||||||

| Haruhiko Sato | Director, Managing Executive Officer |

● | ● | ● | ● | ● | ○ | ||||||||

| Yuri Sasaki | Director Outside DirectorIndependent Director |

● | ○ | ○ | ○ | ○ | |||||||||

| Kayoko Kawamura | Director Outside DirectorIndependent Director |

● | ● | ○ | ○ | ○ | ○ | ||||||||

| Shota Kondo | Director Outside Director |

● | ● | ● | ● | ○ | ○ | ○ | ○ | ||||||

| Yoshitaka Shiba | Director, Audit & Supervisory Committee Member | ● | ● | ● | ● | ● | ○ | ◎ | ○ | ||||||

| Hiroyasu Nakata | Director, Audit & Supervisory Committee Member Outside DirectorIndependent Director |

● | ○ | ○ | ○ | ○ | ◎ | ||||||||

| Hiroko Kaneko | Director, Audit & Supervisory Committee Member Outside DirectorIndependent Director |

● | ● | ○ | ○ | ○ | ○ | ○ | |||||||

| Masayuki Saito | Director, Audit & Supervisory Committee Member Outside DirectorIndependent Director |

● | ● | ● | ● | ● | ● | ○ | ○ | ○ | ◎ | ○ | |||

(Note) ◎:Chairperson, ○:Member

Status of Activities of the Board of Directors, Audit & Supervisory Committee, and Other Committees

<Board of Directors>

The meetings were held 14 times in fiscal year 2024, where important management matters such as the Medium-term Management Plan, major investment projects, business strategies of each business division, and IR activities were deliberated and decided. In addition, the rationality of cross-shareholdings was verified. Furthermore, the status of audit is reported from the Audit & Supervisory Committee in a timely manner.

Important policies and other matters are deliberated at the Board of Directors meetings. The content of matters deliberated by the Executive Committee and its advisory committees regarding risk management, compliance, sustainability, etc. is regularly reported to the Board of Directors.

Attendance at the Board of Directors meetings by Directors in fiscal year 2024 was as follows:

| 14/14 times (100%) | Takahiro Yanai, Taiju Hisai, Kazumi Anei, Haruhiko Sato, Yuri Sasaki, Hiroyasu Nakata, Hiroko Kaneko, Masayuki Saito |

| 11/11 times (100%) | Aiichiro Matsunaga, Kayoko Kawamura, Yoshitaka Shiba (Note 1) |

| 10/11 times (91%) | Shota Kondo (Note 1) |

(Note 1) Four Directors–Mr. Aiichiro Matsunaga, Ms. Kayoko Kawamura, Mr. Shota Kondo, and Mr. Yoshitaka Shiba–were appointed Directors at the Annual General Meeting of Shareholders held on June 25, 2024; therefore, the above shows their attendance after that date.

<Audit & Supervisory Committee>

Audit & Supervisory Committee meetings are held every month, in principle. Audit & Supervisory Committee meetings were held 15 times in fiscal 2024, where these activities on 1) Formulation of audit policies, audit plans, and priority audit items for the year, 2) Reporting on business execution by business execution divisions, and 3) Matters related to business reporting, financial results documents, etc., were deliberated and also decided.

Attendance by Directors in fiscal 2024 was as follows:

| 15/15 times (100%) | Hiroko Kaneko, Masayuki Saito |

| 11/11 times (100%) | Yoshitaka Shiba, Hiroyasu Nakata (Note 2) |

(Note 2) Two Directors–Mr. Yoshitaka Shiba and Mr. Hiroyasu Nakata–were appointed Directors (Audit & Supervisory Committee Members) at the Annual General Meeting of Shareholders held on June 25, 2024; therefore, the above shows their attendance after that date.

<Governance Committee>

Committee meetings were held nine times in fiscal year 2024, where PDCA was conducted for effectiveness assessment by deliberating the manner of effectiveness assessment for the Board of Directors and the analysis of the assessment results. Also, various governance guidelines were comprehensively reviewed, issues at MHC were identified, and multifaceted discussions were held about the composition of the Board of Directors members, the expansion of the roles of Outside Directors, the improvement of the effectiveness of the Board of Directors, and other matters.

Attendance by Directors in fiscal year 2024 was as follows:

| 9/9 times (100%) | Takahiro Yanai, Taiju Hisai, Yuri Sasaki, Hiroyasu Nakata, Hiroko Kaneko, Masayuki Saito |

| 7/7 times (100%) | Aiichiro Matsunaga, Kayoko Kawamura, Shota Kondo, Yoshitaka Shiba (Note 3) |

(Note 3) Four Directors–Mr. Aiichiro Matsunaga, Ms. Kayoko Kawamura, Mr. Shota Kondo, and Mr. Yoshitaka Shiba–joined the Governance Committee on June 25, 2024; therefore, the above shows their attendance after that date.

<Nomination Committee>

Committee meetings were held six times in fiscal year 2024, which deliberated the reappointment of the President & CEO, the revision of skills that the Board of Directors should possess (skill matrix), etc.

Attendance by Directors in fiscal year 2024 was as follows:

| 6/6 times (100%) | Takahiro Yanai, Yuri Sasaki, Hiroyasu Nakata, Hiroko Kaneko, Masayuki Saito |

| 4/4 times (100%) | Kayoko Kawamura, Shota Kondo (Note 4) |

(Note 4) Two Directors–Ms. Kayoko Kawamura and Mr. Shota Kondo–joined the Nomination Committee on June 25, 2024; therefore, the above shows their attendance after that date.

<Compensation Committee>

Committee meetings were held five times in fiscal year 2024, which deliberated the policy, the system, and the level of officers’ remuneration, evaluation system for officers’ bonuses, and other matters.

Attendance by Directors in fiscal year 2024 was as follows:

| 5/5 times (100%) | Taiju Hisai, Yuri Sasaki, Hiroyasu Nakata, Hiroko Kaneko, Masayuki Saito |

| 4/4 times (100%) | Kayoko Kawamura, Shota Kondo (Note 5) |

(Note 5) Two Directors–Ms. Kayoko Kawamura and Mr. Shota Kondo–joined the Compensation Committee on June 25, 2024; therefore, the above shows their attendance after that date.

Evaluation of the Effectiveness of the Board of Directors

MHC has continued efforts to further improve the effectiveness of the Board of Directors based on annual reviews and assessments conducted by all Directors at the Board of Directors throughout the year for the purpose of maintaining and enhancing the functions of the Board of Directors.

Major initiatives and an overview of the assessment of the effectiveness of the Board of Directors for fiscal 2024 are as follows:

<Major Initiatives in Fiscal 2024>

| Issues in FY2023 | Response to Issues |

|---|---|

| Improving agenda items and the content of deliberations |

|

| Enhancing communication |

|

| Improving information provision system |

|

<Assessment of the Effectiveness of the Board of Directors in Fiscal 2024>

| Assessment Method |

|

|---|---|

| Results |

The major results of the assessment above are shown below:

|

Remuneration for officers

1. Basic Policy

- MHC’s officers’ remuneration is determined by also taking into account officers’ incentives, with a view toward increasing corporate value through the execution of business strategies.

- The level of remuneration shall be appropriate with respect to the roles and responsibilities of each officer, and is also based on market levels, from the viewpoints of increasing corporate value over the medium to long term and improving short-term business performance.

2. Remuneration System

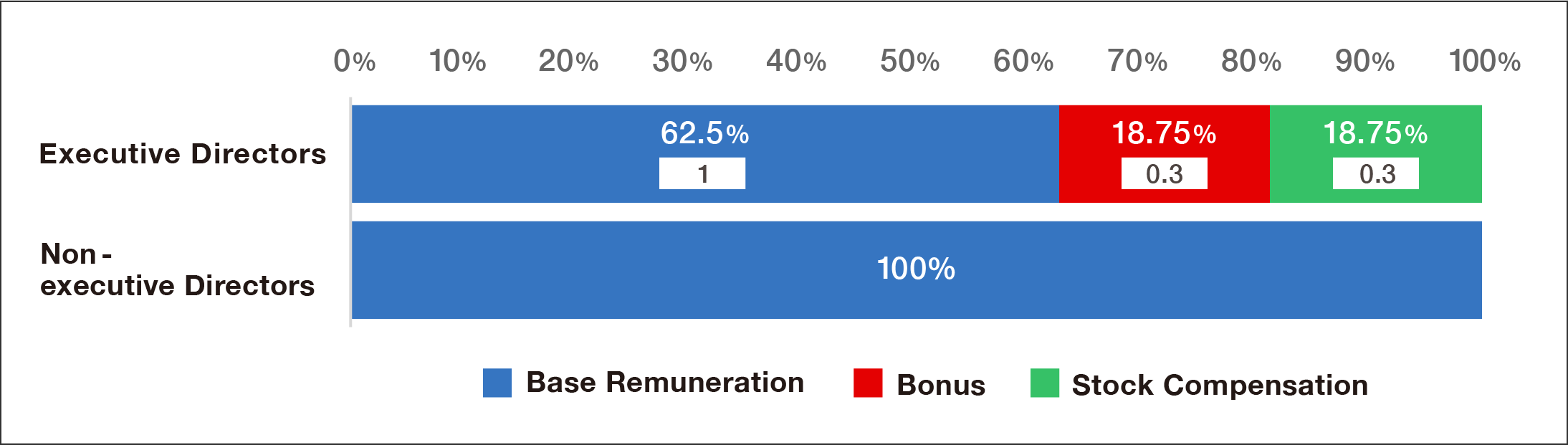

- In principle, Executive Directors and Executive Officers’ remuneration, etc., consists of base remuneration, short-term incentive compensation (performance-based monetary compensation), and medium-to long-term incentive compensation (performance-based stock compensation). As short-term incentive compensation, cash is paid as a bonus, while medium-to long-term incentive compensation is paid as provision of MHC’s shares, etc. in a trust framework.

- With a view toward maintaining a sound performance-based ratio, the ratio of fixed remuneration (base remuneration) to floating compensation (bonus and stock compensation) is generally set at 1:0.6 (the ratio of base remuneration to bonus to stock compensation is generally set at 1:0.3:0.3).

- MHC uses a BIP (Board Incentive Plan) trust, which is closely linked to the medium- to long-term performance of MHC and high in both transparency and objectivity, as the stock option system. The BIP trust is intended to further increase Directors' willingness to contribute to expanding MHC's corporate value over the medium to long term, and to share the benefits and risks of stock price fluctuations with shareholders.

- Bonuses and stock compensation, which represent incentive compensation, are not paid to non-executive Directors (excluding persons who are Audit & Supervisory Committee Members) from the standpoint of ensuring the effectiveness of their supervisory functions, and to Directors who are Audit & Supervisory Committee Members from the standpoint of ensuring the fairness of audits.

- The amounts of remuneration for Directors (Audit & Supervisory Committee Members) shall be decided through discussions among Directors who are Audit & Supervisory Committee Members, within the range resolved at the General Meeting of Shareholders.

<Remuneration System for Executive Officers>

| Type of Remuneration | Details of Remuneration | Percentage of Remune-ration | KPIs for Evaluation/ Evaluation Weight |

Range of Payment Coefficient Based on KPI Achievement | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fixed | Base Remuneration |

|

62.5% 1 |

- | - | |||||||||||||||

| Variation | Bonus (Short-term Incentive)Performance-based |

|

18.75% 0.3 |

|

0 - 150% | |||||||||||||||

| Stock (Medium- to Long-term Incentive)Performance-based |

|

18.75% 0.3 |

|

0 - 150% |

- Return On Assets

- Return On Equity

- Total Shareholder Return

<Composition of Remuneration>

<Malus and Claw-back Clause for Stock Compensation and Shareholding Policy>

As for stock compensation, the points or share conversion points that have already been granted can be confiscated, and money equivalent to MHC’s shares, etc. that have already been delivered reclaimed, in the case of a material violation of the office regulations or internal regulations, resignation for personal reasons during the term of office against the will of MHC, dismissal for justifiable reasons, gaining employment at a competitor without MHC’s permission, etc.

MHC recommends the holding of its shares by its Directors. Further, in principle, Directors shall continue to hold MHC’s shares obtained during the term of their office until the time of their resignation, regardless of the number of shares held.

Policy for Constructive Dialogue with Shareholders

With the recognition that it is one of its social responsibilities to ensure transparent and sound management while emphasizing initiatives to achieve sustainable corporate growth and improvement in corporate value over the medium to long term, MHC pursues proactive and constructive dialogue with shareholders and investors.

With the Corporate Communications Department serving as the primary point of contact, MHC has established a system for collaboration with the Corporate Planning Department, Accounting Department, General Affairs Department, Human Resources Department, etc. to implement the following initiatives.

- Financial results briefings are held quarterly each year, in which the President & CEO and management provide explanations and also answer any questions that are asked.

- MHC’s management and the Corporate Communications Department, conduct individual interviews with domestic and foreign shareholders and institutional investors, and IR and SR activities, such as participation in briefings and various conferences.

- MHC provides a wide range of information such as movies of financial results briefings and materials with scripts provided at the financial results briefings, and summaries of Q&A sessions on the corporate website to investors including individual investors. In conjunction with this, MHC participates in IR events and various briefings for individual investors which are organized by securities companies and stock exchanges.

Opinions and concerns expressed in the dialogue with shareholders are promptly reported to MHC’s management. In addition, those are regularly reported to the Board of Directors so that the information is shared with independent Outside Directors as well. MHC appropriately and carefully manages insider information in accordance with MHC’s internal rules and also discloses such information in accordance with the information disclosure policy. Please refer to the corporate website for the information disclosure policy:

Cross-shareholdings

1. Policies for Cross-shareholdings

Under the corporate policy for enhancing its corporate value, MHC holds listed stocks for the purposes of ① and ② below:

- Developing stable and long-term relationships with business partners and promoting business

- Strengthening such relationships based on capital/business alliances, and creating new business opportunities

In its cross-shareholding practice, MHC’s basic policy is to regularly examine if it is rational to hold each stock and sell those that are judged no longer rational to hold, after gaining understanding of its business partners while considering the impact of sales on businesses and markets.

Even when it is judged as rational to hold stocks, MHC may sell such stocks in consideration of the impact of the risk of mark-to-market valuation fluctuation of the stocks on MHC’s finances, capital efficiency, etc.

The change in the number of listed stocks held since March 31, 2016 is as follows. The number decreased from 134 to 22 as of September 30, 2025.

<Change in the Number of Listed Stocks (Companies)>

- The numbers for March 2016 to March 2021 are the total of those from the former Mitsubishi UFJ Lease & Finance and Hitachi Capital.

The numbers for March 2017 to March 2021 do not include the numbers of stocks cross-held by both companies.

2. Method for Verifying the Rationality of Cross-shareholdings

MHC’s cross-shareholding policy is decided based on ① and ② below and its rationality is verified at the Board of Directors. (See the figure below.)

- A quantitative evaluation based on factors including the amounts of business transactions/profits, dividends received, and capital costs

- A qualitative evaluation of the business activities to date and potential business opportunities in the future

3. Verification of Rationality by the Board of Directors

The Board of Directors examined the listed shares using the method outlined in 2. above at the Board of Directors meeting held in fiscal year 2025.

4. Basis for Exercising Voting Rights

MHC exercises its voting rights for cross-shareholdings in light of the purposes described in 1. above.

Concerning the following agendas which MHC thinks may affect the enhancement of corporate value and the sustainable growth of MHC and its business partners over the medium to long term, MHC exercises its voting rights after carefully verifying their details and potential impact:

- Agenda on the disposal of surplus

- Agenda on the election of Directors and auditors

- Agenda on organizational restructuring

- Agenda on anti-takeover measures, etc.