Governance

Compliance

Ensuring compliance

The Group strongly recognizes that the trust and confidence of its customers and society are the cornerstones of its existence and considers it of utmost importance to engage in corporate activities based on a high sense of mission and ethics in order to practice Our Mission and achieve Our 10-year Vision. From this perspective, in order to share fundamental values and ethics for compliance and reflect them in business, we have established the Mitsubishi HC Capital Group Code of Ethics and Conduct and various policies related to compliance as guidelines for Group officers and employees.

Code of Ethics

- Establishing Trust

Fully recognizing the weight of our social responsibility and public mission, we aim to establish the unshaken trust of society through complete information management and sound and proper business activities, including the timely and appropriate disclosure of company information. - Customer-Oriented Approach

Consistently taking a customer-oriented approach and having good communication, we offer products and services that best meet customers' needs to obtain customers' satisfaction and support. - Strict Compliance with Laws and Regulations

We strictly adhere to all applicable laws and rules (including social, industry, and company rules) and undertake appropriate and sincere corporate activities in line with social norms. We also respect internationally accepted standards as a corporate group operating globally. - Respect for Human Rights and the Environment

Respecting the personality and character of each other and emphasizing conservation of the global environment that is the shared asset of humankind, we pursue harmony with society. - Exclusion of Anti-Social Elements/Money-Laundering Prevention

We take a resolute stance against anti-social elements that threaten the order and safety of civil society. In compliance with all applicable laws and regulations related to preventing money laundering, we take every possible measure to block money laundering and terrorist financing.

Compliance management framework

The Mitsubishi HC Capital Group regards compliance as one of its most important management challenges. As such, it has established a compliance management framework under which the Board of Directors assumes ultimate supervisory responsibility. The Board of Directors regularly receives reports from the Chief Compliance Officer (CCO) and the Compliance Committee, and oversees the group's overall compliance status, including compliance with the Code of Ethics and the Code of Conduct, the operational status of the whistleblowing system, and policies for handling material compliance incidents.

Under the supervision of the CCO, who is responsible for overseeing the establishment and operation of the group's compliance management framework, the Legal & Compliance Department plans and manages the internal framework, provides instructions and supervision to each business division and group company, and gives guidance on corrective actions for compliance violations. Meanwhile, the Compliance Committee deliberates the status of compliance with the Code of Ethics, the Code of Conduct, and anti-corruption regulations, as well as on the operational status of the whistleblowing system (Compliance Hotline). It reports the details to the Board of Directors via the CCO, thereby ensuring appropriate supervision by the board.

In the event of a compliance violation, the Legal & Compliance Department promptly reports it to the CCO and management, and determines a response policy under the supervision of the Board of Directors. The group then promptly takes appropriate measures based on the basic policy of fulfilling corporate social responsibility and preventing further harm and recurrence.

In addition, with regard to the whistleblowing system, the CCO regularly reports to the Board of Directors and the Audit & Supervisory Committee on its management and operational status, and proposes improvements as necessary. This framework enables us to ensure the effectiveness of the whistleblowing system and the transparency of its governance.

The Mitsubishi HC Capital Group continues to enhance and improve its compliance management framework through a three-layer structure consisting of supervision by the Board of Directors, oversight by the CCO, and operation by the Legal & Compliance Department.

Compliance efforts

To ensure compliance with the Code of Ethics and Conduct, we have prepared a compliance manual with more specific and easy-to-understand explanations. This manual is published on the company intranet so that all group officers and employees can access it at any time, and we conduct ongoing training.

Compliance-related awareness and education

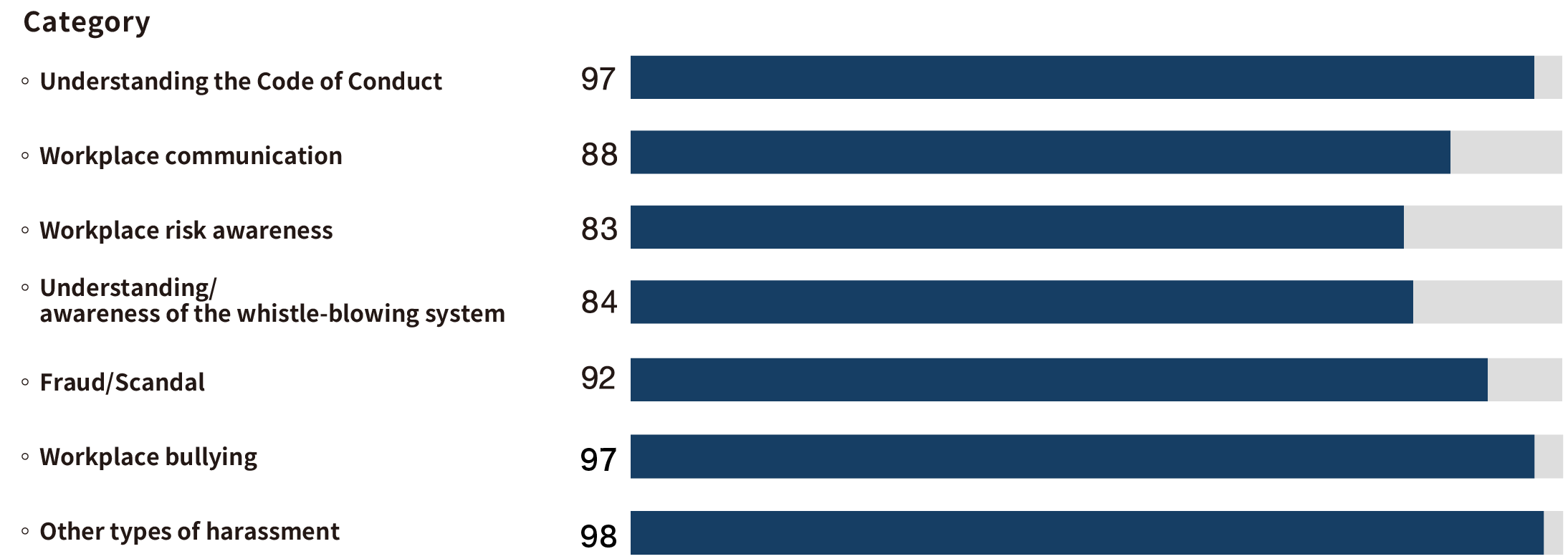

With regard to the various business laws for which the Group is registered and licensed, the Company provides individual training and measures the level of understanding. In addition, the Group provides yearly education on the Code of Ethics and Conduct and other priority items related to compliance and anti-corruption. In addition to training, we conduct periodic monitoring using compliance awareness surveys and self-checks to measure the level of understanding and confirm that understanding has penetrated throughout the Company.

Whistleblowing system

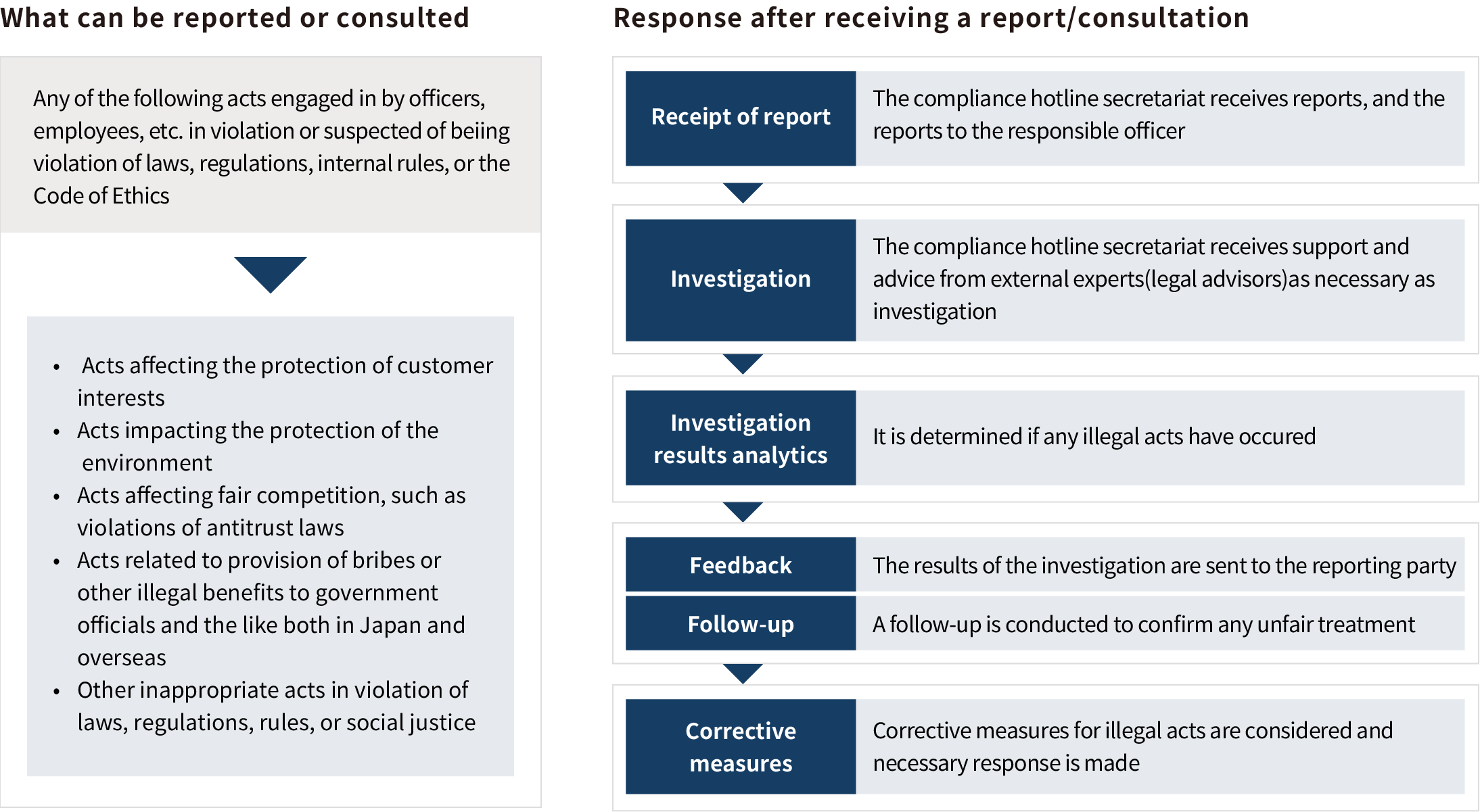

We have two Whisleblowing systems that are 'Compliance Hotline System'and 'Harassment Helpline System'.

We have set up a 'Compliance Hotline System' for officers, employees, etc. to report and consult about misconduct and related issues (any real or suspected violation of laws, regulations, internal rules, or the Code of Ethics by officers, employees, etc. including corruption). In addition, we have established the ‘Harassment Helpline System’ for consulting on harassment acts occurring in the workplace involving officers and employees.

These Whistleblowing systems provide multiple points of contact within and outside the Company where officers, employees, etc. (including those already retired). Also, they can report and consult without hesitation and do it anonymously. Departments and persons in charge that receive reports and consultations are obligated to maintain confidentiality, and officers and employees who report or consult about misconduct or related issues shall receive no disadvantageous treatment whatsoever due to such reporting or consulting.

Principles for Money-Laundering Prevention

The Mitsubishi HC Capital Group ("Group") is striving to enhance our structure and system to prevent money-laundering and terrorist financing (collectively, "Money-Laundering") and eliminate any trade relationship with persons (individuals and entities) subject to sanctions, which violates economic sanctions of the United Nations, international organizations, and individual countries.

- We shall comply with all applicable laws and regulations for preventing Money-Laundering in and outside the country.

- Recognizing Money-Laundering prevention as one of our critical challenges, the top management of each company of the Group shall proactively and aggressively tackle this issue.

- With regard to persons subject to sanctions identified under the UN Security Council's resolution and by OFAC or other regulatory authorities, we shall check and screen every contemplated transaction appropriately according to applicable laws and regulations.

- Taking the risk-based approach, we shall appropriately manage customers and transactions to address the risks in the Money-Laundering.

- We shall monitor all transactions continuingly, and if any of them is suspected of being involved in Money-Laundering, we shall report it to relevant authorities as required.

- We shall provide training programs continuously to maintain and improve awareness about Money-Laundering prevention of the officers and employees of the Group and their capability to deal with those transactions.

- We shall ensure the appropriate business operation for Money-Laundering prevention by conducting regular internal audits and other processes.

Prevention of fraud and corruption

The Group complies with laws and regulations relating to prohibition of fraud, corruption, bribery, etc. applicable to countries and areas where the Group operates, and prohibits acts of fraud, entertainment and gifts, giving or receiving bribes, etc. that may invite suspicion or distrust from society.

In addition, all officers and employees of the Group will observe the following:

- Do not conduct any form of corruption such as money laundering, embezzlement and obstruction of justice.

- Fully understand laws and regulations, and not provide entertainment or gifts that may invite suspicion or distrust from society, or offer any money or other benefits for the purpose of gaining any unfair advantage to Japanese or foreign public officials or any other persons equivalent thereto.

- Maintain a firm stance against antisocial forces that threaten the order and safety of the civil society and do not have any relationship whatsoever with them, including business relationships.

- Do not conduct any act that may violate insider trading regulations.

- Do not give or receive gifts to or from business partners that deviate from social norms or sound business practices.

- Do not take advantage of position and authority in the Company to make a demand to business partners, etc. for private profit.

Number of violations related to anti-corruption regulations

There were no violations of anti-corruption regulations that may significantly affect the management of the Group.

Fines for corruption

No payments related to corruption were made, such as payments of fines and other costs related to penalties or compensation.